UP

LEVEL

MY ROLE

Visual Designer

Logo

INDUSTRY

Budgetting

and

Banking

TEAM

UX Mellanie & Will

UI Ana & Katie

DURATION

3 Weeks

OVERVIEW

There are many factors that are preventing people from reaching their financial goals such as lack of informations, guidance and support to name a few. Our research goal is to understand the different habits and method that young adults have in their lives to manage their finances and reach their goals.

We want to understand their reasoning when it comes to manage their revenue and the challenges that they are facing.

We hope the insight we gain from our research will help us develop a platform where young adults can have access to resources they need to improve their budgeting and savings/investing skills. Through our partnership with Zelle consortium, Level Up creates a robust, custom financial benchmarks for users pf any status- built upon a massive consumer database from partner institutions.

BUSINESS MODEL CANVAS

PROBLEM STATEMENT

Insight

Problem/ Persona

How might we provide Maya a way to see the possible paths they might take to reach their ultimate financial goals?

Young adults have difficulty visualizing the habits necessary to undertake in the present in order to arrive at some imagined future lifestyle and financial state.

As a result, Maya doesn’t have confidence in how her current financial behavior compares to peers and “goal” comparators.

Goal

RESEARCH METHODOLOGY

We conducted 4 moderated interviews through Zoom, and 1 interview in person. Each member of our team rotated the role of the interviewer, lead notetaker, and timekeeper/notetaker on body language and user quotes. We used the same discussion guide for each participant to ensure consistency in data. We asked follow-up questions as needed, such as asking 'Why' to extract more insight from a participant. We recorded each interview and used Otter to transcribe for us to refer back to later as necessary.

Take a look at the complete case study

RESEARCH SYNTHESIS

PERSONA

PERSONA

JOURNEY MAP

FEATURE PRIORITIZATION MATRIX

MuShCoWo Map

As we thought through our persona and user’s journey map some features felt more essential than we initially thought. For example, we concluded that our resources feature is essential because our users need the ability to obtain real life experience lessons and trustful resources to improve their ability to manage their income and navigate the savings/investments world

DESIGN PHASE

PHASE I

Sketching

We did a round of sketches, taking inspiration from our other team members' ideas and incorporated them into one whole idea. based on the feature prioritization on the MuShCoWo Map.

PHASE II

MID-FI

Once we decided on a design, our team built the architecture and interactivity of our platform. We created wireframes to communicate our concept and intent, and thought deeply about the functionality of each feature as our persona might interact with and through the platform.

Our wireframes have limited visual design, no color, no images, and basic functionality.

Our annotated wireframes also inform the intentionality of each feature we decided

to include in our design, communicating the reasoning behind our design based on our research findings.

PHASE III

HI-FI

Clickable prototype bellow

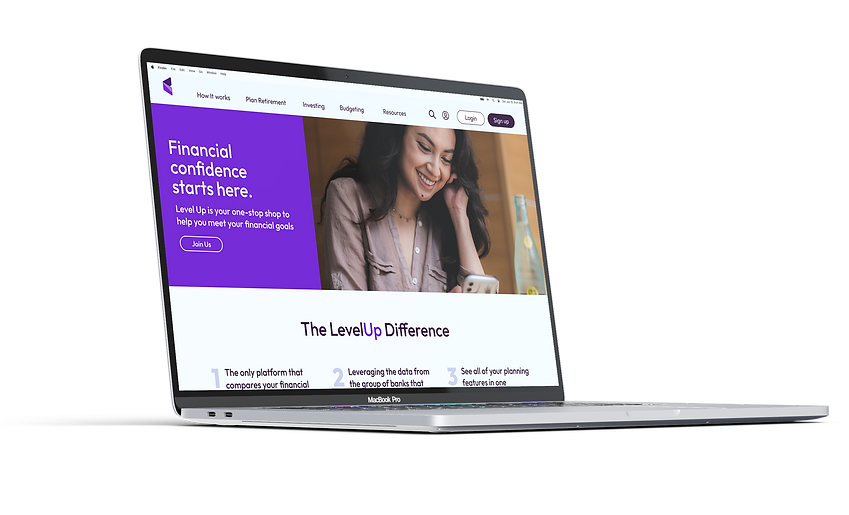

LANDING PAGE

User clicks on Sign Up button to start

creating an account.

SIGN UP/LOG IN

CONNECT ACCOUNTS

A window will pop-up with instructions for the user to follow.

User clicks "Begin" to continue.

DASHBOARD

User can select his different accounts

to connect them to his profile, and click

"CONTINUE to go to the next step".

BUILD BUDGET PAGE

User is now in his dashboard section

and clicks Edit Budget to build or personalized budget.

User will have access to details

of new budget.

NEXT

STEPS